Highest Paying Remote Jobs Without A Degree

## **Unlock Your Potential: High-Paying Remote Jobs You Can Land Without a Degree** The traditional…

## **Unlock Your Potential: High-Paying Remote Jobs You Can Land Without a Degree** The traditional career ladder is getting a modern makeover. In today’s dynamic job market, the prerequisite of a formal college education is no longer the sole gatekeeper to lucrative employment. A seismic shift is underway, empowering individuals to access financially rewarding, location-independent…

Attaining self-sufficiency through accumulated wealth to cease employment before traditional retirement age involves a multi-faceted approach. This typically includes creating a detailed financial plan, aggressively saving and investing, and minimizing expenses to create a passive income stream sufficient to cover living costs indefinitely. For example, a person might pursue this by investing in dividend-paying stocks…

Optimizing personal finances through strategic spending reductions involves employing clever techniques and strategies across various expenditure categories. This might include preparing meals at home rather than dining out, consolidating debt to lower interest payments, or leveraging discounts and coupons for groceries and other necessities. Effectively implementing such practices can lead to significant cumulative savings. The…

Selecting promising digital assets for long-term growth requires careful consideration of various factors, including technological innovation, market capitalization, community strength, and real-world utility. For example, a cryptocurrency with a strong development team, active community, and a clear roadmap for future development might be considered a more attractive investment than one lacking these attributes. Strategic cryptocurrency…

Launching a successful supplementary enterprise involves a multifaceted process, encompassing idea generation, market research, operational planning, and effective marketing strategies. Consider a hypothetical scenario: an individual with a passion for baking begins selling custom cakes locally. This exemplifies the core concept identifying a marketable skill or product and developing a structured approach to offering it…

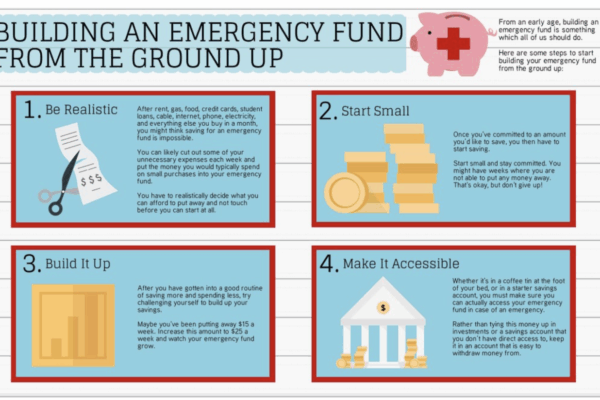

Creating a financial safety net involves a methodical approach. This process typically begins with assessing one’s current financial situation, including income, expenses, and existing debt. A clear budget helps identify areas where expenses can be reduced to free up funds for saving. Next, a savings goal is established, often based on three to six months…

Developing a robust financial plan involves understanding income and expenses, allocating resources strategically, and consistently setting aside funds for future goals. This includes tracking spending, identifying areas for reduction, and establishing realistic savings targets. For example, one might analyze monthly credit card statements to pinpoint non-essential expenditures and then redirect those funds toward a high-yield…

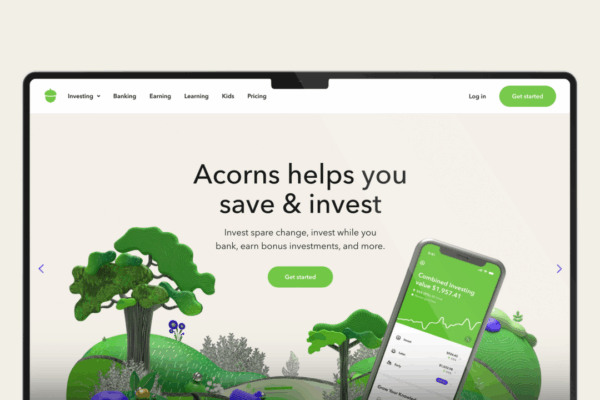

Beginning stock market participation with limited capital involves utilizing accessible platforms and focusing on smaller initial investments. For example, fractional shares allow individuals to purchase portions of high-priced stocks, enabling diversified portfolio construction even with a modest budget. Similarly, exchange-traded funds (ETFs) offer a cost-effective way to gain exposure to a basket of securities, mimicking…

Selecting suitable investment platforms is crucial for new investors. Optimal platforms offer user-friendly interfaces, educational resources, and low fees. They may also provide fractional shares, automated investing options, and access to diverse asset classes like stocks, bonds, and exchange-traded funds (ETFs). For example, a platform might offer a curated selection of ETFs designed for specific…

Managing finances with limited resources requires careful planning and disciplined spending. It involves creating a budget, prioritizing essential expenses, and identifying opportunities to reduce costs without sacrificing basic needs. For example, preparing meals at home rather than dining out, utilizing public transportation or carpooling instead of individual vehicle use, and seeking affordable entertainment options like…